偶尔看到的,转上来给大家参考一下

Mobile Ads Growing Rapidly: Apple Leads In Monetizing Content

November 22, 2012 | 22 commentsby: Andy Batts | about: AAPL, includes: GOOG, SSNLF.PK

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

The mobile advertising market seems to be going disproportionately in one direction. According to the results of a recent examination of the market by the mobile ad network Adfonic, that direction is straight toward Apple (AAPL).

In the latest version of iPhone, Apple removed two mainstay apps, both Google (GOOG) products -- Maps and YouTube. Maps are particularly crucial on mobile devices, where location-based services and ads have emerged as the pathway to making money. Location-based services are very important for Google in terms of generating ad revenues, and search is very tied to that. Apple's rejection of YouTube is part of its effort to cut ties with its former friend.

Even though Android phones far outnumber iPhones with 60 percent of smartphones run Android, versus 34 percent for iPhones -- iPhone users account for almost half of mobile traffic to Google Maps, research firm Canalys reports. Being kicked off the iPhone may have potentially significant consequences for Google, the move will undoubtedly help Apple in generating more ad revenues.

Apple's mobile ads make more money than Google's

Late Steve Jobs once said that Google's search-based advertisements were not the future for mobile devices because users tended to spend their time inside "apps" rather than browsing the web. "On a mobile device, search is not where it's at, not like on the desktop," he said. "They're using apps to get to data on the internet, not generalized search."

Ads that run on Apple's iPhone command significantly higher prices than Android, and way higher prices than any other mobile platform, according to a report from mobile browser maker Opera Software, which also operates a mobile ad network.

The iPhone leads the smartphone OS pack with an average eCPM of $2.85. Though it is closely followed by Android devices (at $2.10). The rest of the mobile phone field is significantly behind.

This indicates that devices with better usability (i.e., larger screen size, touchscreen) and those with features that allow more interaction between the advertisement and the device's functionality (e.g., click to call, expand, play video) have better monetization potential than less capable and less user-friendly devices. For example, HTML5 Canvas, the mobile-friendly browser feature that specialist developers use to build stunning animations and full-screen rich-media overlays, relies on iOS Safari 3.2 and Android 2.1 or above to run.

We also see the importance of device market share in encouraging advertisers to target particular devices. Windows phones have most if not all of the advanced features of Android and iPhones, but low levels of user adoption stifle its performance.

The iPad in particular gets the highest effective cost per 1,000 impressions (eCPM) of all devices, which is $3.96.

"Overnight, Apple has really taken out a significant chunk of Google's market, and it's much harder for Google to say to developers, 'We're the only game in town, come play with us,' " said Tony Costa, a senior analyst who studies mobile phones at Forrester. "It will affect the Google ecosystem, putting it back in the same game of their apps lagging behind Apple, and that's not a good position for them to be in."

Apple's iAd platform needs improvement

It's hard to ignore the signs of trouble with Apple's mobile advertising platform, iAd. Despite lowering the minimum fee and simplifying their CPM and performance-based pricing, iAd's new minimum cost is still out of reach for the majority of advertisers.

The minimum ad spend on iAd requires a big commitment before ever seeing results, and performance advertisers are more likely to profit by using transparent ad networks that offer real-time tracking and the ability to switch ad placement and targeting on a moment's notice, depending on how it's performing. Tangibility and flexibility are two key components absent from iAd's platform, and these missing pieces make performance advertisers wary.

Apple needs to make its iAd platform a success, and as we all know Apple is here to stay, it's only a matter of time iAd starts to dominate the mobile advertising space.

Apple's rising mobile ad revenue will boost stock price

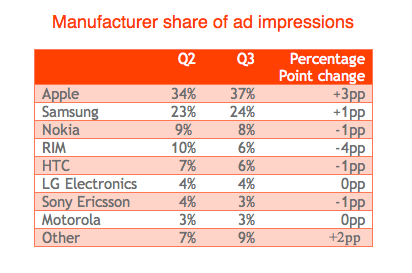

Apple in Q3 accounted for 37% of all mobile ad impressions on its network, with Samsung (SSNLF.PK) the second-most popular at 24%, and the rest trailing some ways behind, Adfonic says. It will be interesting to see what happens in Q4. In its AdMetrics report, Adfonic notes that Apple increased its lead over Samsung by three percentage points without much impact from the iPhone 5, which only hit the market at the end of the period. So one way of charting iPhone 5 popularity will be to see what kind of an impact it has on Apple's ranking in the current Q4 quarter.

Meanwhile, Apple's stock witnessed steep correction before bouncing back from $505, the level that I pointed out in a previous article. The stock is currently trading in deep value zone with an estimated P/E multiple of just 11 for 09/2013. Given the company's earnings will grow by at least 20% annually over the next two years, investors should start accumulating the stock in every decline.

评论